10 Signs Your Property Needs a Wildfire Risk Assessment

A wildfire risk assessment is not just paperwork — it’s your roadmap to lowering ignition odds, qualifying for insurance, and protecting what you’ve built. Many homeowners wait until an inspection notice or insurance non-renewal before acting, but the clues are usually visible long before that. This piece breaks down 10 clear signs your property needs a wildfire risk assessment, and what an Ember Pro assessment actually delivers. It also doubles as a wildfire hazard checklist, helping you evaluate your home or community right now.

If you see even two or three of these warning signs, it’s time to schedule a professional wildfire risk assessment and document your mitigation plan.

1. Your roof or vents are older than 10 years

Older vents often have quarter-inch mesh that lets embers through. Roof systems degrade over time, losing their Class A protection. If your vents aren’t one sixteenth inch mesh or tested ember-resistant, embers can enter and ignite materials in the attic.

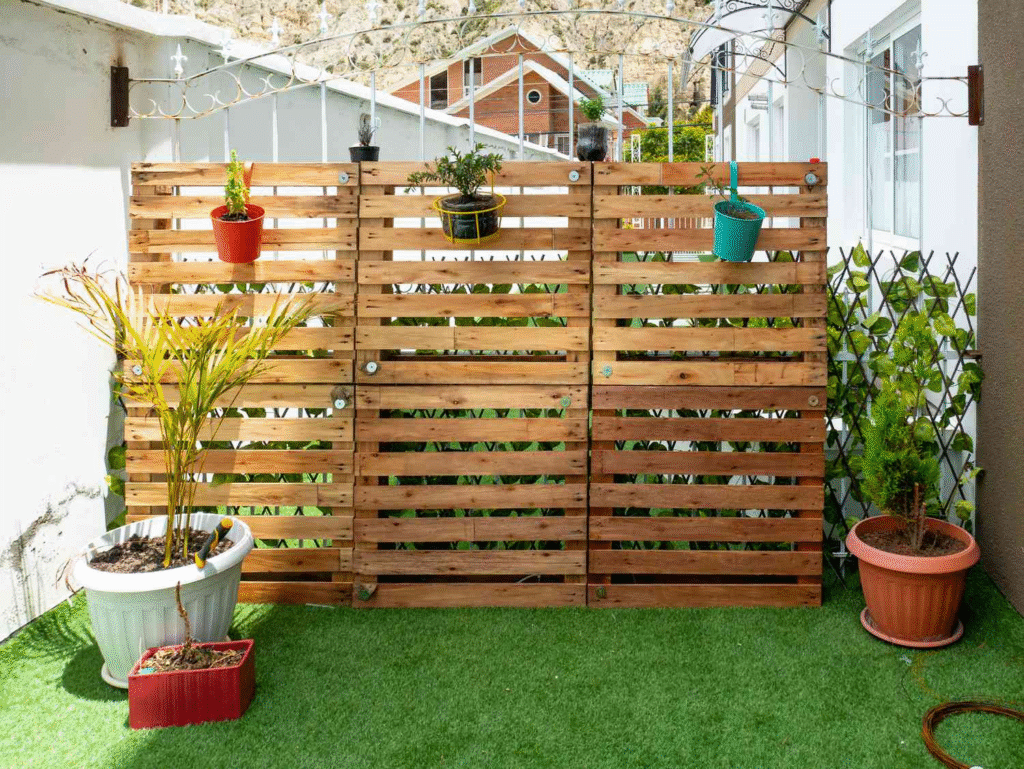

2. You have wood mulch or fences attached to your home

Zone 0 (the first five feet from walls) is where most homes ignite. Wood mulch, decorative bark, and wood fencing connected to siding all create a continuous fuel path. Replace with gravel, pavers, or metal fencing sections near the structure.

3. Gutters or roofs collect pine needles and leaves

Embers land where debris accumulates. If you find buildup along roof edges or in gutters, your ignition probability jumps. Install metal gutter guards and clear them before red-flag events.

4. Landscaping grows within five feet of walls

Bushes, vines, and planters next to siding act as fuel ladders. Non-combustible hardscape within Zone 0 is one of the highest-ROI wildfire upgrades.

5. Your community has dense vegetation or shared greenbelts

HOAs and neighborhoods with continuous vegetation or canyon edges share exposure. A community or HOA risk assessment identifies shared hazards and creates a single action plan instead of piecemeal efforts.

6. You’ve received a non-renewal or notice from your insurer

Carriers increasingly require proof of mitigation. A documented assessment with photos, specs, and before/after scores provides what underwriters need. Include a wildfire hazard checklist in your report to verify compliance with insurer mitigation standards.

7. You’re in a Shelter-in-Place community or limited egress area

If evacuation is not always possible, you need a verified plan for embers, vents, and perimeter fuels. An assessment defines what hardening or clearance must be completed first and provides a wildfire hazard checklist for maintenance throughout the season.

8. You added new structures or remodels after 2015

Decks, patio covers, and ADUs can change airflow and exposure. A fresh risk assessment ensures all new features meet Chapter 7A wildfire construction standards and appear on your property’s wildfire hazard checklist for compliance.

9. You’re in an area with repeat smoke or red-flag events

If your neighborhood sees annual smoke, ashfall, or PG&E Public Safety Power Shutoffs, you’re in a high-exposure corridor. Risk assessments pinpoint your vulnerabilities and help you qualify for mitigation credits.

10. You’ve never had a formal wildfire assessment

Most homeowners haven’t — and that’s the biggest sign of all. Professional wildfire risk assessments combine fire behavior science with site specifics, turning guesswork into a plan. Ember Pro packages findings with clear priorities, costs, and insurer-ready documentation. You’ll also get a wildfire hazard checklist to track your improvements and re-evaluate each season.

What Happens After Your Assessment

You receive:

- A photo-documented report identifying ignition pathways.

- A prioritized list of Immediate, Next, and Later actions.

- A cost guide for low-cost retrofits and community options.

- Insurer documentation pack and your property’s wildfire hazard checklist for faster underwriting.

FAQs

Is a wildfire assessment the same as a defensible space inspection?

Not exactly. Defensible space covers vegetation, while a wildfire risk assessment includes the building envelope, vents, decks, and materials — your complete wildfire hazard checklist.

How often should I repeat an assessment?

Every three to five years, or after roof replacements, remodels, or major landscaping changes.

Will it lower my insurance premium?

In high-risk ZIP codes, verified mitigation first unlocks eligibility. Discounts usually follow as carriers adopt more credit programs.

Leave a Reply