Can Wildfire Defense Systems Lower Your Insurance?

Wildfire defense systems and pre‑season spray services don’t just help lower premiums, they help you get quoted, secure coverage, and protect resale value. In California’s tight market, underwriters reward verifiable mitigation: hardening, defensible space, documented defense systems, and environmentally safe long‑term spray with annual reporting.

“Homeowners won’t out‑argue the market. We have to out‑mitigate it. When enough homes reduce real risk and can prove it, carriers have a reason to come back.” Competition will solve this crisis and homeowners have to create a competitive market to attract the insurers.”

Jim Sprouse, CEO, Ember Pro

1. The Short Answer

Yes, defense systems and spray can help lower cost and availability risk, especially when part of a verified mitigation plan.

2. How We Got Here (CA Market)

California’s homeowners market has tightened sharply. Here’s the short version of why it feels so hard right now:

- Carrier pullbacks & non‑renewals. Seven of California’s 12 largest property insurers have limited coverage, with selective appetites and re‑underwriting across books. Several high‑profile carriers announced non‑renewals (e.g., tens of thousands of property policies), further shrinking admitted capacity.

- FAIR Plan ballooning. Demand has surged~1,000 people/day seeking coverage; the FAIR Plan now insures $320B+ (up roughly 6× from $50B in 2018). Expect layering and administrative friction (long hold times, slower processing).

- E&S shift. As admitted carriers retrench, placement is moving to Excess & Surplus (E&S) markets. Industry growth has been rapid, and non‑admitted policies can run ~30–40% higher than standard market pricing (while offering needed flexibility).

- Rate & regulation changes. The Department of Insurance has been approving more rate filings and is moving to allow catastrophe modeling in rate‑making. The intent: stabilize availability and better reflect forward‑looking wildfire risk (with expectations that carriers write more in distressed areas as rates catch up).

- Heavier documentation. Underwriting is asking for more detail like photos, inspections, mitigation proof and some carriers limit how many new submissions brokers can send in a month. A clean, verifiable file materially improves results.

What this means for you: Coverage is still available, but it often looks different; non‑admitted, higher deductibles, wildfire deductibles/exclusions, reduced limits, and more questions. Your mitigation file needs to be strong and organized to unlock options.

3. Is California the Most Expensive?

On pure price, Florida and parts of Texas often rank higher due to wind/hurricane and severe storm exposure. California’s challenge is availability and underwriting scrutiny.

4. What Insurers Credit

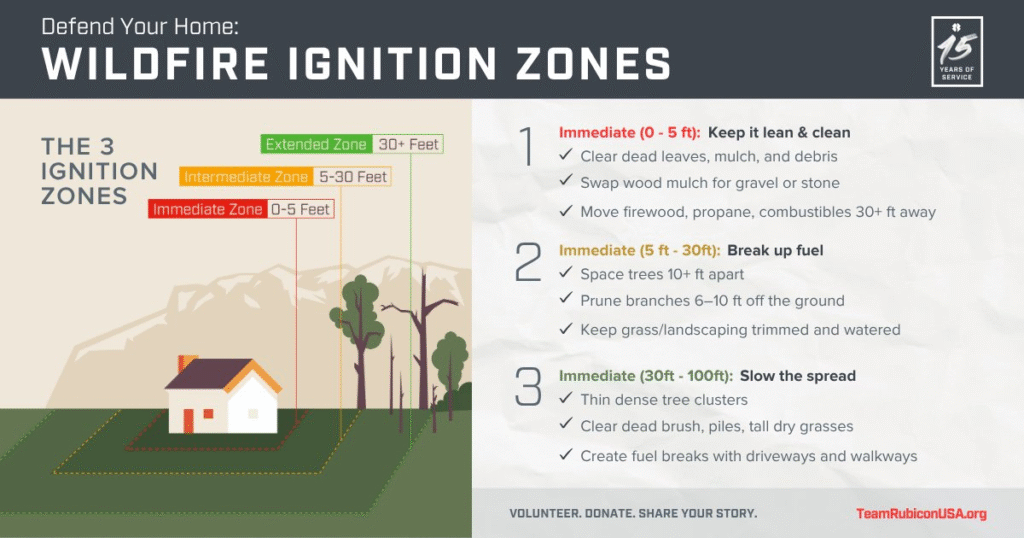

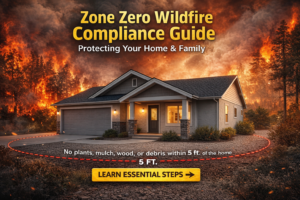

- Ignition resistance: ember‑resistant vents/screens, Class A roof, non‑combustible Zone 0.

- Defensible space: maintained and photographed.

- Active protection: Wildfire Defense (WFD) Systems that can deploy safe inhibitor at the structure; Spray Services applying an environmentally safe, long‑term inhibitor on nearby fine fuels/edges ahead of season.

- Verification: annual service records, geo‑tagged photos, coverage maps for spray, and inspection logs.

5. The Ember Pro Proof Stack

We package mitigation proof so underwriters can say yes.

- Assessment → 25–50 geo‑tagged photos, exposure map, checklist.

- Plan → prioritized hardening, WFD system layout, spray zones.

- Install → off‑grid/safe‑fail system; commissioning photos & report.

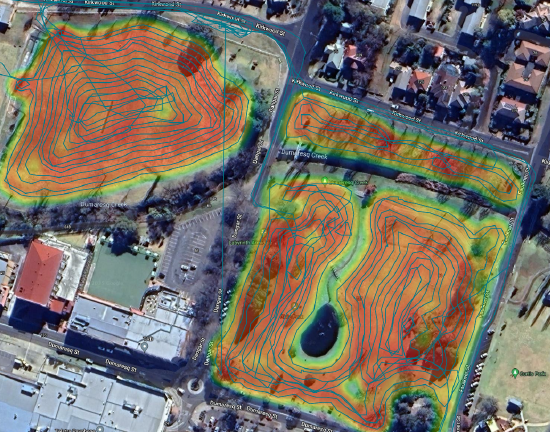

- Spray → eco‑safe long‑term inhibitor; coverage heat map + gallon/zone logs.

- Annual packet → summary letter, photos, specs/SDS, service logs, maps, and a 1‑page ROI.

Spray report/heat map example:

6. The Process if you are selling a house (30‑Day Listing Timeline)

Start ~30 days before listing: Info form → fire score → assessment → MGA review → soft quote → owner choice → bind → mitigation → annual reporting. Avoids last‑minute surprises and keeps deals intact.

7. ROI: Will a Defense System Pay for Itself?

Three returns to track:

Availability ROI: unlocking quotes/markets you wouldn’t otherwise access.

Price ROI: potential credits for verified mitigation (varies by carrier).

Loss‑Avoidance ROI: the big one, lower odds of a total loss. CalFire says ‘it’s not if, it’s when’

Resale ROI (small but important): A recent analysis using CoreLogic California home‑sales data with Penn State University economists finds that homes built to enhanced wildfire‑resistant codes (a proxy for hardening) sell for roughly 1.4%–2.5% more than comparable pre‑code homes, evidence that mitigation can return value at resale, not just at renewal [1].

8. FAQs

Do insurers approve specific brands?

No universal list. Underwriters want proof of lowered risk and verifiable upkeep.

Do I still need spray if I install a system?

Yes—systems protect during an event; spray reduces seasonal ignition risk in fine fuels.

What if rules change again?

Mitigated homes with clean docs stay easier to insure in any market.

How big are the discounts, realistically?

It varies by carrier and file quality. In some cases, combined hardening + defensible space + documented systems/spray have earned single‑ to mid‑teen % credits; availability benefits (actually getting multiple quotes) are often the bigger win. Not guaranteed.

What proof should I include with my application?

Assessment photos, receipts/specs for hardening upgrades, annual service logs, coverage maps for spray, SDS, before/after photos, contractor invoices, defensible‑space inspection, and a 1–2 minute exterior video walkthrough.

How often do I service the system and refresh spray?

Plan on annual system inspection and a pre‑season spray each year, with post‑storm reassessment for targeted touch‑ups if rainfall is significant.

Will the system work during a power outage?

Yes—our specs prioritize off‑grid/safe‑fail operation with manual activation. We’ll confirm water source/pressure and add backup options where needed.

I’m selling soon—when should I start?

Follow the timeline: begin ~30 days before listing (info form → fire score → assessment → soft quote → mitigation → bind), so insurance doesn’t derail escrow.

9. Contacts & Next Steps

Book a Wildfire Insurance Readiness Assessment

Info@emberprousa.com • (858) 939-9345 • www.emberprousa.com

10. Notes & Sources

[1] PSU/CoreLogic housing analysis (2025): Using CoreLogic California sales (2013–2020), homes built under enhanced wildfire codes sold for ~1.4%–2.5% more than comparable pre‑code homes; benefit–cost suggests premiums roughly offset retrofit costs over time.

• California Department of Insurance – Sustainable Insurance Strategy.

• California FAIR Plan – growth & limits.

• HUB Brokerage – State of the Market (California).

• CoreLogic Wildfire Risk Report (2024) – at‑risk homes & reconstruction cost totals.

• National/state premium comparisons (FL, TX vs. CA).

Leave a Reply