Survivability Sells: How to Increase Home Value with Wildfire Protection

Here’s the truth: buyers don’t just want a beautiful home anymore — they want one that can survive. In today’s California housing market, insurance is often the first question buyers ask, and that concern isn’t going away. From wine country to the coast, nearly every region of California faces wildfire risk.

Wildfire Protection and Home Value

A 2025 study conducted by Penn State University, using over six million housing transactions from CoreLogic, revealed something powerful:

- Homes with basic wildfire hardening measures sold for 1.4 to 2.5 percent more than unprotected homes (source: Insurance Institute for Business & Home Safety).

But wildfire hardening is only the beginning.

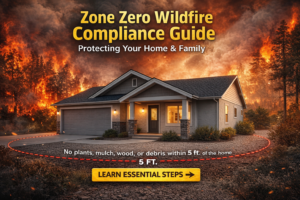

Going Beyond the Basics with a Wildfire Defense System

A Wildfire Defense System takes protection further. It doesn’t just reduce risk; it actively shields your property. For buyers and insurers, this visible safeguard signals preparedness, safety, and long-term value.

Homes equipped with WFD systems now sell for 4 percent or more above comparable listings.

The ROI of Wildfire Protection

Imagine you’re listing at three million dollars. A four percent premium adds $120,000 to the sale price. With an installation cost around $25,000, that’s nearly a five times return on investment.

This makes wildfire protection one of the highest-value upgrades a homeowner can invest in.

👉 See how we help homeowners prepare in our blog: Wildfire Home Protection That Safeguards More Than Property.

Why Buyers Pay More for Protected Homes

Today’s buyers aren’t just thinking about curb appeal. They ask three critical questions before making an offer:

- Can I get insurance?

- Will this home survive a wildfire?

- Is this safe for my family?

A WFD system answers all three with confidence.

Transferrable Insurance Coverage

Here’s a benefit no basic upgrade can match: transferrable fire insurance coverage.

Currently, the only transferrable fire insurance policies available in California are for homes with WFD systems installed. These policies stay with the house, eliminating last-minute surprises for sellers and delivering peace of mind to buyers.

In ZIP codes where securing coverage is nearly impossible, this feature makes your home not only more valuable but also more marketable.

👉 Learn more about coverage challenges in our blog: The Hidden Costs of California FAIR Plan Wildfire Coverage.

The Emotional Factor: Safety and Peace of Mind

The decision to buy isn’t just financial. It’s deeply emotional. Families want to feel safe. They want certainty. They want confidence that the home they choose will protect them.

A wildfire defense system delivers that reassurance. It detects, suppresses, and responds when it matters most.

What a WFD System Delivers

- Up to 4 percent price premium

- A five times ROI vs installation cost

- More buyer interest, even in high-risk zones

- Insurance certainty with transferrable coverage

- Peace of mind for buyers and families

- Differentiation that helps close deals

Stand Out in a Competitive Market

A WFD-equipped home immediately rises above the pack. It’s not just another listing. It’s a secure, insurable, ready-to-close property in a fire-prone state where that combination is rare and getting rarer.

If you live in California, you live in a fire zone. And it’s not a matter of if, but when.

Be the home that’s already prepared, survives, and sells higher than the comps.

Take Action: Increase Home Value with Wildfire Protection

The best defense against wildfires is preparedness. Protect your investment, your buyers, and your family’s future by upgrading with a wildfire defense system.

👉 Download our comprehensive Wildfire Action Plan guide today and take the first step toward resilience.

Leave a Reply