The Hidden Crisis in Wildfire ALE Coverage

Author: Jim Sprouse, Co-founder of Ember Pro, BS in Environmental Studies from Allegheny College, Certified Wildfire Defense Specialist

Expert Review: Ryan Kresan, COO and Co-founder, Ember Pro

Insights, Wildfire Recovery, Insurance, California Wildfires

Introduction

After a wildfire, most survivors expect that insurance will help them get back on their feet. Policies talk about coverage, protection, and peace of mind. One provision in particular often sounds reassuring during the early days after evacuation or loss: Additional Living Expenses, commonly referred to as ALE.

ALE coverage is meant to pay for temporary housing, food, and daily living costs while a home is being repaired or rebuilt. On paper, it sounds like a lifeline.

In reality, ALE coverage is one of the most misunderstood and most limited parts of a homeowners insurance policy. For many wildfire survivors across California, ALE runs out long before life returns to normal, leaving families financially exposed at their most vulnerable moment.

This article explains what ALE coverage actually includes, where it falls short, and why relying on insurance alone can be a costly mistake. It also explains how wildfire defense systems reduce the risk of ever needing ALE in the first place.

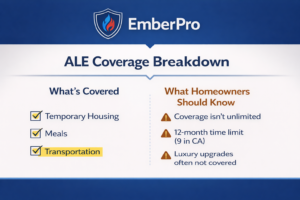

What Is ALE Coverage

Additional Living Expenses coverage is designed to reimburse policyholders for the increased cost of living elsewhere when their home becomes uninhabitable due to a covered loss, such as wildfire.

In theory, ALE covers:

- Temporary housing such as rentals or hotels

- Increased food costs compared to normal spending

- Laundry expenses

- Pet boarding in some cases

- Storage fees

The key word is increased. ALE does not replace your normal cost of living. It only covers the difference between what you normally spend and what you spend because you are displaced.

That distinction matters more than most people realize.

How ALE Coverage Is Typically Structured

Most California homeowners policies limit ALE coverage in one of three ways:

- A percentage of the dwelling coverage, often 20 to 30 percent

- A fixed dollar amount

- A time limit, commonly 12 to 24 months

Whichever limit is reached first ends coverage.

For example, if a policy provides 20 percent of a one million dollar dwelling limit, ALE would cap at two hundred thousand dollars. Once that amount is spent, coverage ends, even if the home is not rebuilt.

Why ALE Runs Out Faster Than Expected

Rebuilding Takes Longer Than Coverage Allows

Wildfire rebuilding in California rarely happens quickly. Delays are common due to:

- Debris removal and environmental testing

- Permitting backlogs

- Labor shortages

- Material supply issues

- Updated building code requirements, including defensible space and Zone 0 compliance under AB 3074

Even when insurance is cooperative, full rebuilds often take two to four years. ALE coverage, however, is usually exhausted within one to two years, sometimes sooner.

This gap creates a financial cliff for survivors.

Temporary Housing Costs Are Extremely High

After a wildfire, demand for housing spikes overnight. Entire neighborhoods may be displaced at once.

In areas like Los Angeles County, Santa Barbara, and San Diego, rental prices can be steep even under normal conditions. After a fire, short-term rentals often cost two to three times normal market rates.

A modest rental that might normally cost four thousand dollars per month can easily rise to eight or ten thousand dollars. ALE may cover the increase at first, but it drains policy limits rapidly.

ALE Does Not Cover Everything People Assume It Does

Many survivors are surprised to learn that ALE often does not cover:

- Furniture rental

- Long-term storage beyond a limited period

- Replacement of lost conveniences

- Costs related to commuting changes

- Lost income or business interruption for homeowners

Additionally, reimbursements usually require meticulous documentation. Receipts must be submitted, reviewed, and approved. Payments are often delayed.

The Emotional and Financial Toll of ALE Exhaustion

When ALE runs out, families are forced to make difficult choices:

- Move again to cheaper housing, disrupting schools and routines

- Dip into savings or retirement accounts

- Take on debt

- Delay rebuilding decisions

- Leave the community entirely

This stage is often described by survivors as the most stressful part of recovery, even more difficult than evacuation or loss.

The insurance process may still be ongoing, but day-to-day support has ended.

ALE and Partial Losses, A Common Trap

ALE coverage applies only when a home is deemed uninhabitable.

In many wildfire cases, homes suffer smoke damage, ember intrusion, or partial structural damage. These homes may technically be habitable, even though living in them is unsafe or impractical.

In these situations:

- ALE may be denied or limited

- Repairs may take months while occupants are expected to remain or pay out of pocket

- Disputes arise over habitability definitions

This gray area leaves many survivors without adequate support despite legitimate hardship.

The Insurance Gap No One Talks About

Insurance is designed to indemnify, not to restore life as it was.

ALE is not intended to replicate the stability, comfort, or security of a permanent home. It is a short-term bridge. When the bridge ends before the destination is reached, the consequences are profound.

This gap is especially painful for:

- Families with children

- Elderly homeowners

- People with pets or special needs

- Home-based businesses

Why Wildfire Defense Systems Change the Equation

The most reliable way to avoid the limitations of ALE coverage is simple in concept, though not in execution: do not lose the home.

Wildfire defense systems reduce the likelihood of:

- Total structure loss

- Extended displacement

- Long rebuild timelines

- Insurance disputes over habitability

By preventing ignition from embers and radiant heat, these systems dramatically reduce the need for ALE in the first place.

Prevention Is the Only Guaranteed Coverage

No insurance policy can fully protect against:

- Emotional displacement

- Community disruption

- Multi-year rebuilding

- Rising construction costs

Wildfire defense systems act as risk elimination, not risk transfer.

When a home survives a wildfire:

- ALE is never triggered

- Families return sooner

- Repairs are limited

- Insurance claims are simpler

- Recovery is faster

This is why more homeowners, especially those who are underinsured or effectively self-insured, are prioritizing mitigation over reliance on post-loss coverage.

ALE and Community Impact

When large numbers of residents rely on ALE simultaneously, communities suffer secondary effects:

- Rental markets become distorted

- Local workers are priced out

- Schools lose enrollment

- Businesses lose customers

- Neighborhoods fragment

Preventing structure loss preserves not just individual households, but entire communities.

This ties directly into the concept of community immunity discussed in earlier articles. Fewer losses mean fewer displaced families and less strain on housing infrastructure.

Commercial Properties Face ALE-Equivalent Challenges

While ALE applies to homeowners, commercial properties face similar limitations through business interruption coverage.

These policies often:

- Cap coverage duration

- Exclude certain losses

- Require detailed proof of income loss

- Delay payouts

When a commercial structure burns, employees may be displaced, customers lost, and operations disrupted for years. Defense systems protect not just buildings, but livelihoods.

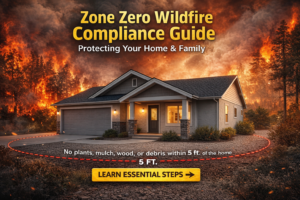

How AB 3074 and Defensible Space Fit In

California’s move toward stricter defensible space requirements under AB 3074 reflects a recognition that prevention is more effective than recovery.

Zone 0, the five feet immediately surrounding structures, is where most ignitions occur. Wildfire defense systems are designed to protect this zone directly.

Homes that comply with defensible space requirements and use active defense systems are far less likely to experience losses that trigger ALE.

10 Frequently Asked Questions About ALE Coverage

- What does ALE stand for?

Additional Living Expenses. - How long does ALE coverage last?

Typically 12 to 24 months or until a dollar limit is reached. - Does ALE cover full rent?

Only the increase above normal living expenses. - Can ALE be extended?

Extensions are rare and require insurer approval. - Does ALE cover furniture rental?

Usually not. - What happens when ALE runs out?

The homeowner pays living expenses out of pocket. - Does ALE apply to partial damage?

Only if the home is deemed uninhabitable. - Is ALE included in the FAIR Plan?

Yes, but limits are often lower than standard policies. - Can mitigation affect ALE eligibility?

Mitigation reduces the likelihood of needing ALE at all. - What is the best way to protect against ALE limitations?

Prevent structure loss with defensible space, home hardening, and wildfire defense systems.

Final Thoughts

ALE coverage is often described as a safety net, but for many wildfire survivors, it becomes a trap door. When it disappears, families are left exposed during the longest and most difficult phase of recovery.

The hard truth is this: insurance helps after a loss, but only prevention protects against displacement.

Wildfire defense systems, combined with defensible space, Zone 0 compliance, and thoughtful home hardening, offer something insurance never can, the ability to stay in your home and your community.

In wildfire country, the most compassionate, cost-effective strategy is not relying on ALE. It is avoiding the loss altogether.

Leave a Reply